#Annual inventory turnover formula free

If a company reduces the amount of time between the date of the initial inventory purchase and conversion of a marketable finished good into revenue, the result is greater free cash flow (FCF) – all else being equal. Most companies strive to reduce their average inventory period over time, as it is generally accepted that a lower days inventory outstanding (DIO) indicates greater operating efficiency.Ī reduction in the time that inventory spends in storage signifies that the company is turning its inventory stock into cash more quickly, which is typically as a result of understanding customer behavior, cyclical or seasonal trends, and/or leveraging data to place orders accordingly.įor the most part, a lower duration is perceived more favorably because it implies a company can sell its finished goods efficiently without stockpiling inventory. The less inventory build-up there is, the more free cash flow (FCF) a company generates – all else being equal.

#Annual inventory turnover formula how to

How to Interpret Average Inventory Period Unlike the income statement, the balance sheet is a snapshot of a company’s assets, liabilities, and equity at a specific point in time.Ĭonsidering the mismatch in timing, the solution is to use the average inventory balance, which is the average between the beginning-of-period and end-of-period inventory carrying values according to the company’s B/S. The formula for calculating the inventory turnover, as mentioned earlier, is COGS divided by the average inventory balance.ĬOGS is a line item on the income statement, which covers financial performance over time, whereas inventory is taken from the balance sheet. distressed companies), most calculations are performed on an annual basis, where the number of days in an annual period would be 365 days. Unless analysis of a company’s near-term liquidity is the reason for tracking the metric (i.e. Average Inventory Period = Number of Days in Period ÷ Inventory Turnover.The formula for calculating the average inventory period is as follows.

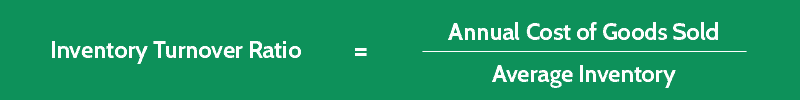

Average Inventory = (Ending Inventory + Beginning Inventory) ÷ 2.The average inventory equals the sum of the current period and prior period ending inventory balance, divided by two. Inventory Turnover = Cost of Goods Sold (COGS) ÷ Average Inventory.There are two inputs required to calculate the working capital metric:

Until the inventory is sold and converted into cash, the cash cannot be used by the company, because the cash is tied up as working capital. finished goods spend less time sitting in storage waiting to be sold. In effect, the efficient management of inventory results in fewer days, i.e. The average inventory period, or days inventory outstanding (DIO), is a ratio used to measure the duration needed by a company to sell out its entire stock of inventory.Ī company’s management team tracks the average inventory period to monitor its inventory management and ensure orders are placed based on customer purchasing patterns and sales trends. How to Calculate Average Inventory Period

The Average Inventory Period is the approximate number of days it takes a company to cycle through its inventory.

0 kommentar(er)

0 kommentar(er)